Bitcoin ETFs Broke The Market

Bitcoin ETFs had a great first day, racking up $4.5B in trading volume. BlackRock's iShares Bitcoin Trust, traded as IBIT on Nasdaq, played a big part, getting close to $1B in volume and making up 22% of the total across all 10 spot Bitcoin ETFs.

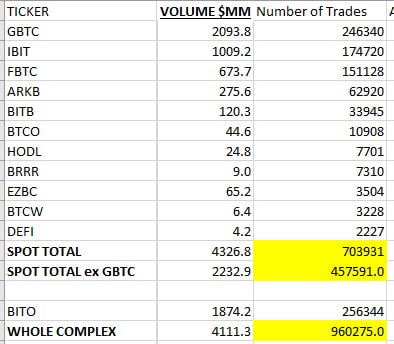

There were 700,000 individual trades involving the 11 spot ETFs today. To put it in perspective, this is twice the number of trades for $QQQ (one of the largest ETFs offered by Invesco), although $QQQ handles much larger dollar volumes.

With this volume, the first 10 spot Bitcoin ETFs broke the Wall Street record set by the first Gold ETF back in 2004. Then, State Street Corporation launched Gold Shares (GLD) and racked up $1.63B in volume on opening day.

However, there’s a little downside to all this. While the total trade was $4.6B, GBTC was 50% of that $2.3B. The GBTC numbers were majority sales/outflows due to the higher fees and the old Bitcoin being locked up, which means that we didn’t have any net inflows...

@Cryptocurrency_Inside