‘Bond King’ Bill Gross Predicts Q4 Recession: Loan Delinquencies and Regional Banks in the Crosshairs

On the social media network X (formally Twitter), the bond connoisseur

Bill Gross publicly shared his projection of a deceleration in the U.S. economy’s momentum come the fourth quarter.

“Regional bank carnage and recent rise in auto delinquencies to long-term historical highs indicate U.S. economy slowing significantly,” Gross said.

“Recession in 4th quarter,” the investor added.

Auto loan tardiness has surged of late, with other financial slip-ups such as consumer loans and credit card lapses reaching peaks not seen in over ten years

. Just last month, an alarming 6% of sub-prime car loan patrons lagged behind by a full 60 days. The unsettling trend of vehicle confiscations began to rise in January and hasn’t looked back since. Intriguingly, while auto loans and other consumer debts reveal escalating delinquency,

single-family mortgage payment misses haven’t shown the same consistent uptrend in 2023, though they’ve inched upward.

In Gross’s commentary on X, he emphatically noted,

“I’m seriously considering regional banks again,” following up with the investment advice:

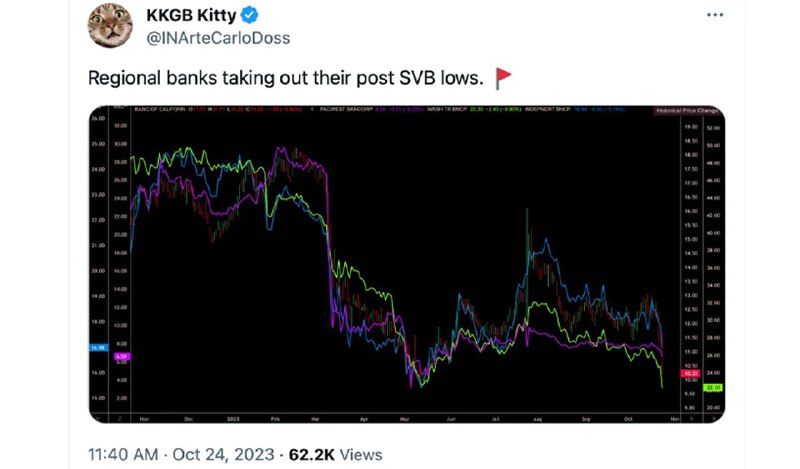

“On bonds. Invest in the curve.” The year has seen regional banks not only underperforming but also plummeting even deeper than their lows during the SVB debacle. The financial institution Huntington Bank felt the pressure, shuttering dozens branches across the Midwest.

These regional financiers, are heavily

tied to commercial real estate (CRE) and are grappling with the rising defaults. This, coupled with consecutive Federal rate boosts, has nudged their unrealized

losses perilously close to the edge.